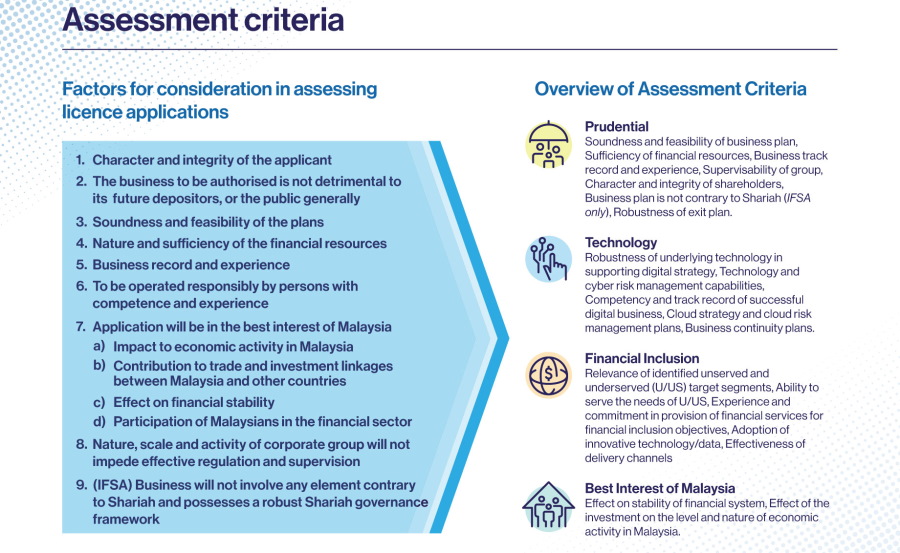

All the successful applicants are made of consortiums instead of a single entity. Here is the full list as provided by BNM: – A consortium of Boost Holdings Sdn. Bhd. and RHB Bank Berhad; – A consortium led by GXS Bank Pte. Ltd. and Kuok Brothers Sdn. Bhd; and – A consortium led by Sea Limited and YTL Digital Capital Sdn Bhd. – A consortium of AEON Financial Service Co., Ltd., AEON Credit Service (M) Berhad and MoneyLion Inc. – A consortium led by KAF Investment Bank Sdn. Bhd. The first three consortiums in the list will be focusing on conventional digital banks while the other two have been provided with Islamic digital bank licences. It is still going to take some time before these digital bank licence holders are able to serve customers though as BNM stipulates that they have to go through “a period of readiness” and an audit by the central bank which could take around 12 to 24 months. Previously, the central bank had planned to reveal the successful applicant in March 2022 alongside the publication of its 2021 Annual Report. However, the bank then decided to delay the announcement in order to allow for the completion of the legal process surrounding the licence. A general look at the selection process for the digital bank licence. [Image: Bank Negara Malaysia.]The establishment of digital banks is meant to deliver financial services to underserved markets. They will have no physical branches and will be delivering their service through digital means such as websites and mobile apps. Additionally, they may also use alternative data in order to determine credit scoring which would allow them to broaden their customer’s reach. This is especially for those that have limited credit history and may have been facing difficulties when they try to obtain services from traditional banks. (Source: Bank Negara Malaysia.)