Luno’s journey into becoming fully authorised by the SC technically started back in 2015. In 2017, the exchange ran into several issues with Bank Negara Malaysia (BNM). In the end, and given the volatile nature of cryptocurrency, Luno was effectively barred from operating in Malaysia. With the Internal Revenue Board (IRB) officially freezing all accounts belonging to BitX Malaysia, Luno’s local entity at the time. Instead of exiting the market entirely, though, Luno stuck around and after much back and forth with the SC, the exchange officially registered itself with the commission back in 2018 and gained its approval to operate this October.

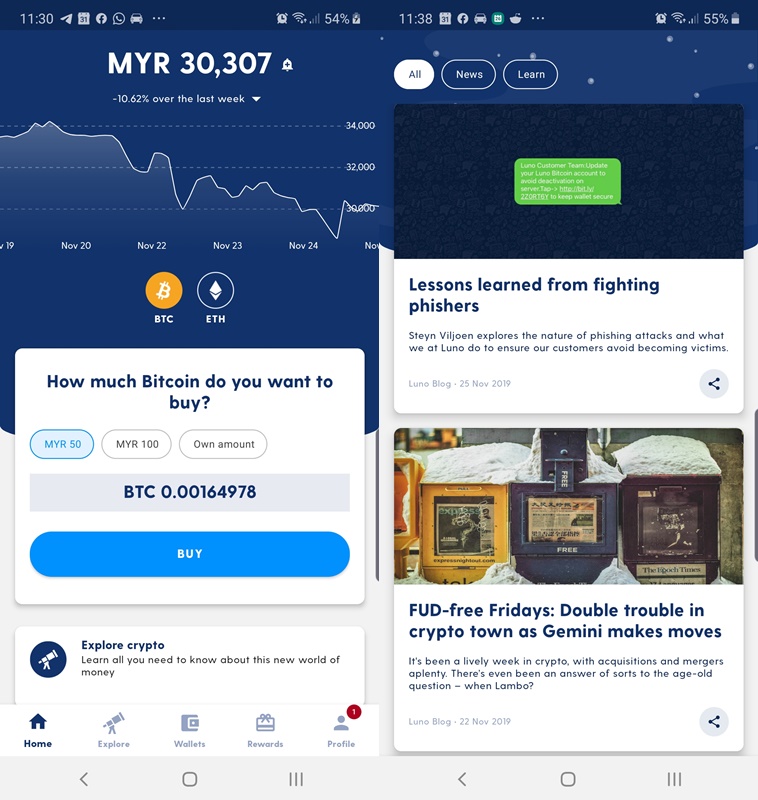

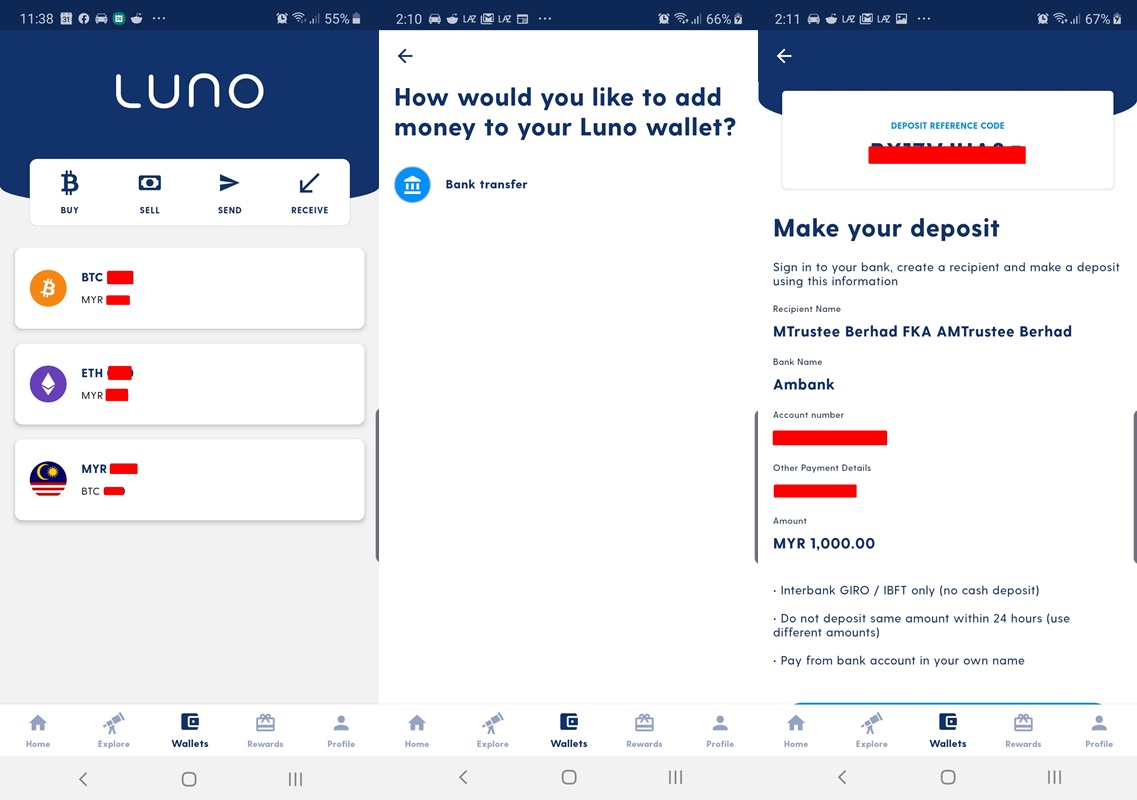

For those among you who are familiar with Luno, you’ll be happy to know that the app remains relatively unchanged, save for one or two updates. As it stands, you can only make deposits into the exchange via a bank transfer. We had inquired when Luno intended on making transactions via credit and debit cards available – options that are readily accessible in other countries – to which the market operator said that it was working towards making such options available “step by step”. Additionally, Luno has stated that it intends on adding more cryptocurrency options to the list in time.

Additionally, the Luno app will now prompt you to enter a provided reference code that basically notifies the bank that any and all transactions between you and Luno is legitimate, and doesn’t get flagged down as suspicious. The Luno app is available for download via Google Play and the Apple App Store.